INVL Asset Management’s INVL Partner Global Infrastructure Fund I, which will invest in a fund of infrastructure assets established by a fund manager of global stature with a 26-year track record, announced its first close at USD 29.53 million. A total of 65 investors took part in the initial offering of the fund, including the Invalda INVL group. The fund’s units were distributed by the INVL Family Office.

“The war in Ukraine has led many investors in this part of the world to rethink the diversification of their investment portfolio – the reality is that most money is invested in shares or real estate in the Baltic region. So the chance to invest in a fund far from this ‘home’ market, with most of its assets in the US and the UK, and at the same time to buy some inflation insurance, has been very well received by the market. The results of the offering exceeded our expectations,” said Vytautas Plunksnis, Head of Private Equity at INVL Asset Management.

He said units of the fund would also be offered later, since the target fund accepts investors periodically. The next offering phase is planned to begin in April.

Global infrastructure is an attractive asset class with the trait of inflation protection. A portfolio diversified both geographically and for deal size, predictable income flows, a stable regulatory environment, an investment-grade credit rating and leadership in the environmental, social, and governance (ESG) area all make it possible to seek a significant return for investors.

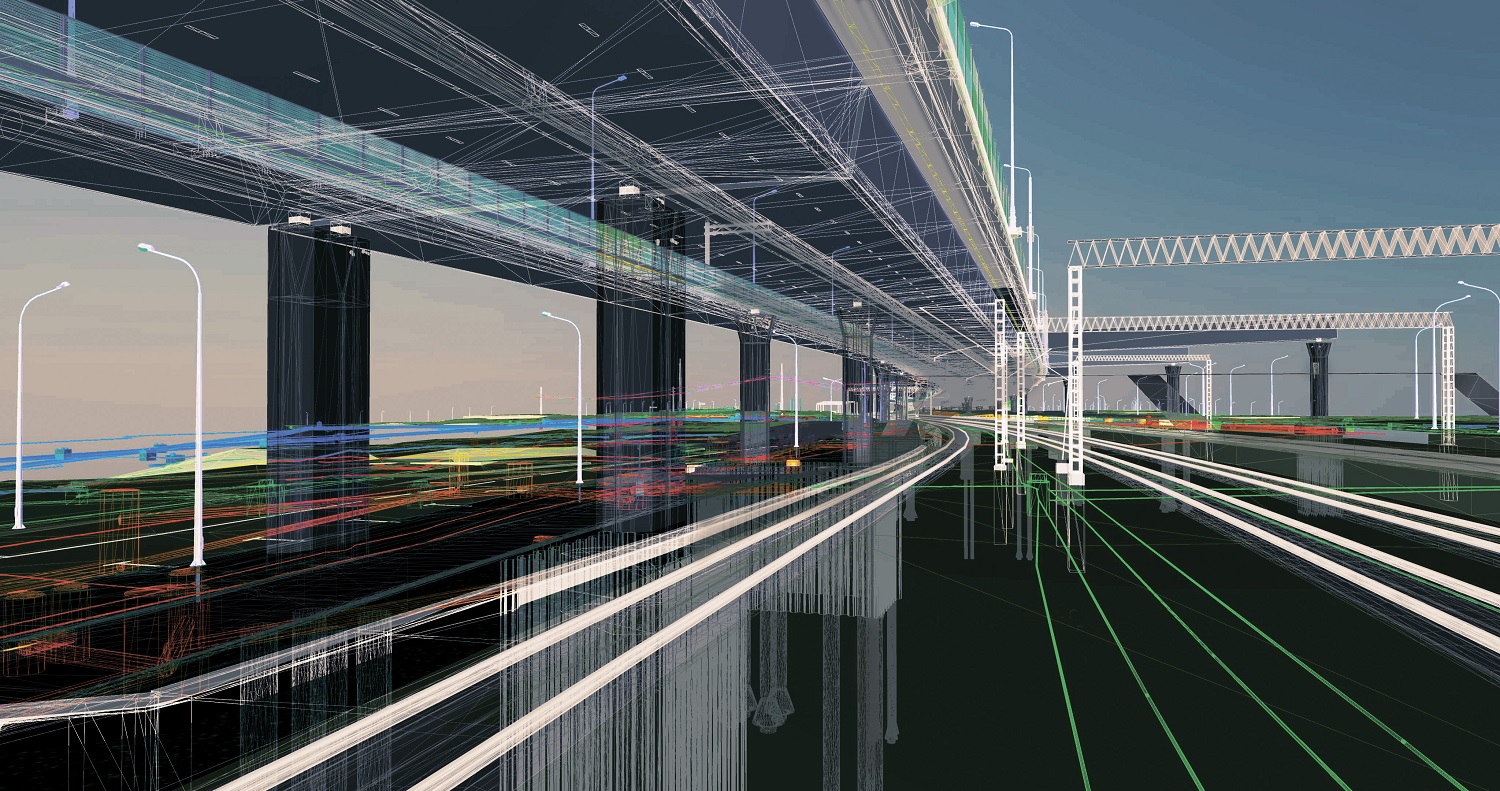

The strategy of investing in infrastructure assets is based on very long-term investment and high-quality core infrastructure in member states of the Organisation for Economic Co-operation and Development (OECD). A large share of the portfolio consists of assets such as toll roads, pipelines, airports and seaports, and product terminals.

In investing, great attention is given to ESG matters. The manager has been a signatory of the Principles for Responsible Investment since 2008 and hopes by 2050 to reach net zero carbon emissions.

The minimum investment in the INVL Partner Global Infrastructure Fund I is USD 145 000. The lifetime of the fund is 50 years, though opportunities for investors to realise their investments earlier are envisaged.

About INVL Asset Management

INVL Asset Management, one of the leading asset management companies in Lithuania, is part of the Invalda INVL Group. The group’s companies manage pension and mutual funds, individual portfolios, private equity and other alternative investments. More than 250,000 clients in Lithuania and Latvia as well as international investors have entrusted the group’s companies with the management of more than EUR 1.5 billion in assets. Invalda INVL, operating since 1991, has nearly 30 years of solid experience in managing private equity assets and building leading market players in their respective fields in the Baltic states and the CEE region.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.