The INVL Sustainable Timberland and Farmland Fund II (STAFF II), which invests in forest and land in the Baltic Sea region and Central and Eastern Europe, acting through its subsidiary Zemvaldos Turtas SPV2, signed an agreement with several subsidiaries of the agribusiness group Linas Agro Group AB to acquire nearly 164 hectares of farmland for EUR 990,000.

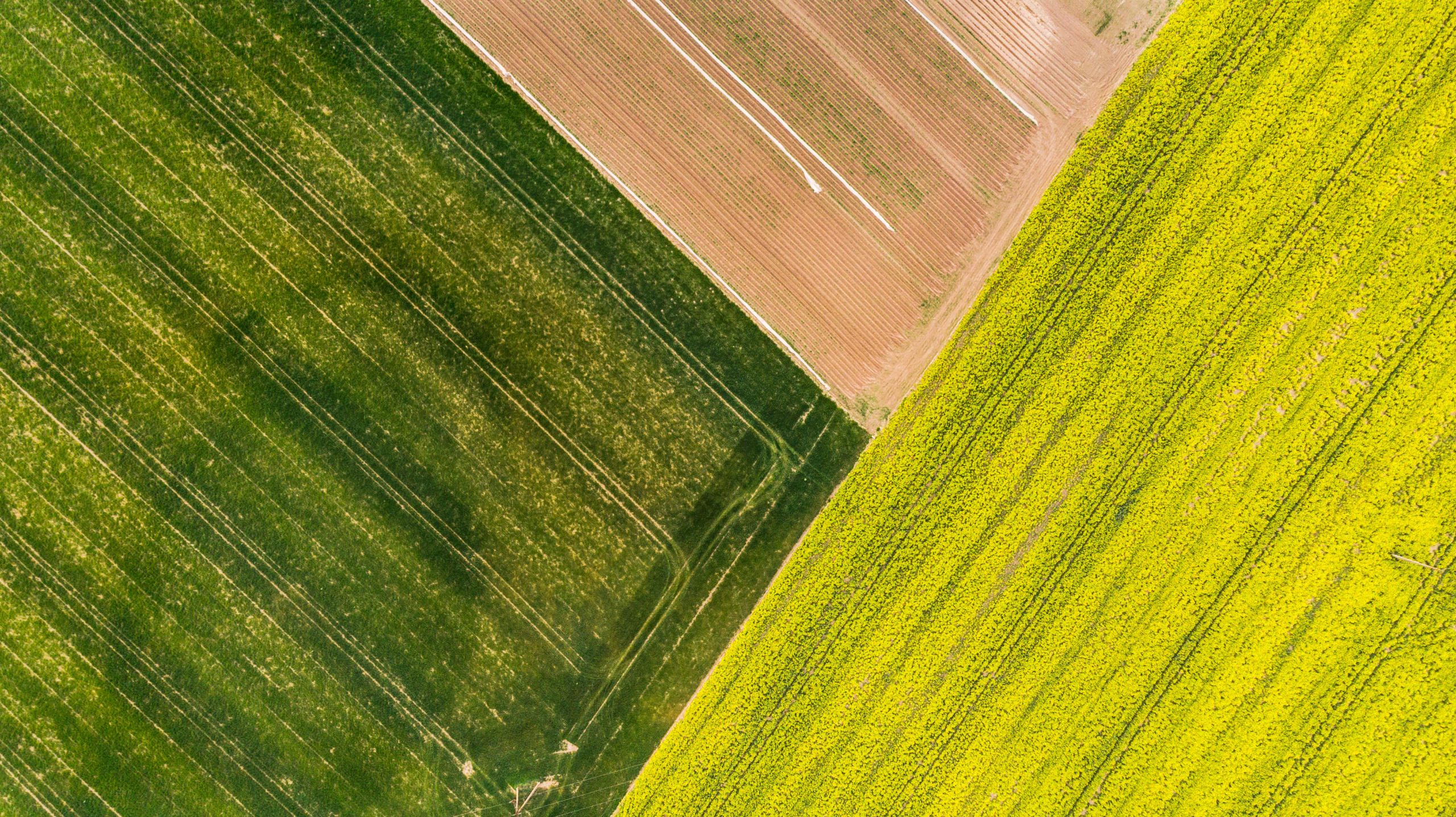

“As foreseen in the strategy of the fund launched a year ago, we are actively continuing operations with a successful acquisition of top-quality agricultural land. The newly acquired areas are characterised by high productivity and are spread across strategically convenient regions of Lithuania. This is one of the fund’s transactions this year that meets goals we set and allows us to promote sustainable farming principles on farmland we own,” said Martynas Samulionis, the fund’s Managing Partner.

He said the acquired farmland plots are in Panevėžys, Vilkaviškis and Joniškis districts. They will be leased to local farmers.

Because the STAFF II fund has an unlimited duration, it can hold acquired assets for a very long time. That is an attractive choice for members of agribusiness community in the Baltics, letting them free up capital by transferring land to a long-term investor.

“We made a decision already last year to increase the efficiency of the management of our asset holdings. We work over 18,000 hectares of land and have about 5,897 hectares of land for our own agricultural operations. Each year we lease some of that land to farmers since some of the plots are too far from our agriculture businesses to be cultivated efficiently. We decided to sell some of those plots and give more attention to priority activities,” said Mažvydas Šileika, the Chief Financial Officer at Linas Agro Group.

The STAFF II fund is investing in the Baltic countries and plans to later expand its existing portfolio in countries of Central and Eastern Europe that belong to the European Union, which offer an attractive investment return and a stable regulatory environment. The fund has a strong focus on the sustainable management of forests and farmland in terms of not just nature preservation but also social responsibility. It bases its activities on sustainable forestry standards and promotes the implementation of sustainable farming principles on agricultural land.

The fund operates under the laws of the Grand Duchy of Luxembourg and invests in individual countries in keeping with the regulatory restrictions set by those countries.

About the INVL Sustainable Timberland and Farmland Fund II (STAFF II)

Launched in the second half of 2020, the fund is administered by the Apex Group, one of Europe’s largest providers of fund services. The fund invests in sustainably managed forests and agricultural land in the Baltic Sea region and Central and Eastern Europe. It is intended for institutional and private investors from EU countries.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.