Did you know that your employer can become a partner that invests in your future? Register for a consultation and learn all about pension accumulation with your employer.

Sign up for a free consultation in the way that works best for you

Pension accumulation with your employer is easier than it might seem. All you have to do is sign a 3rd pillar pension agreement. And if you have any questions – we will answer them in a way which is convenient for you. All you have to do is register for a consultation.

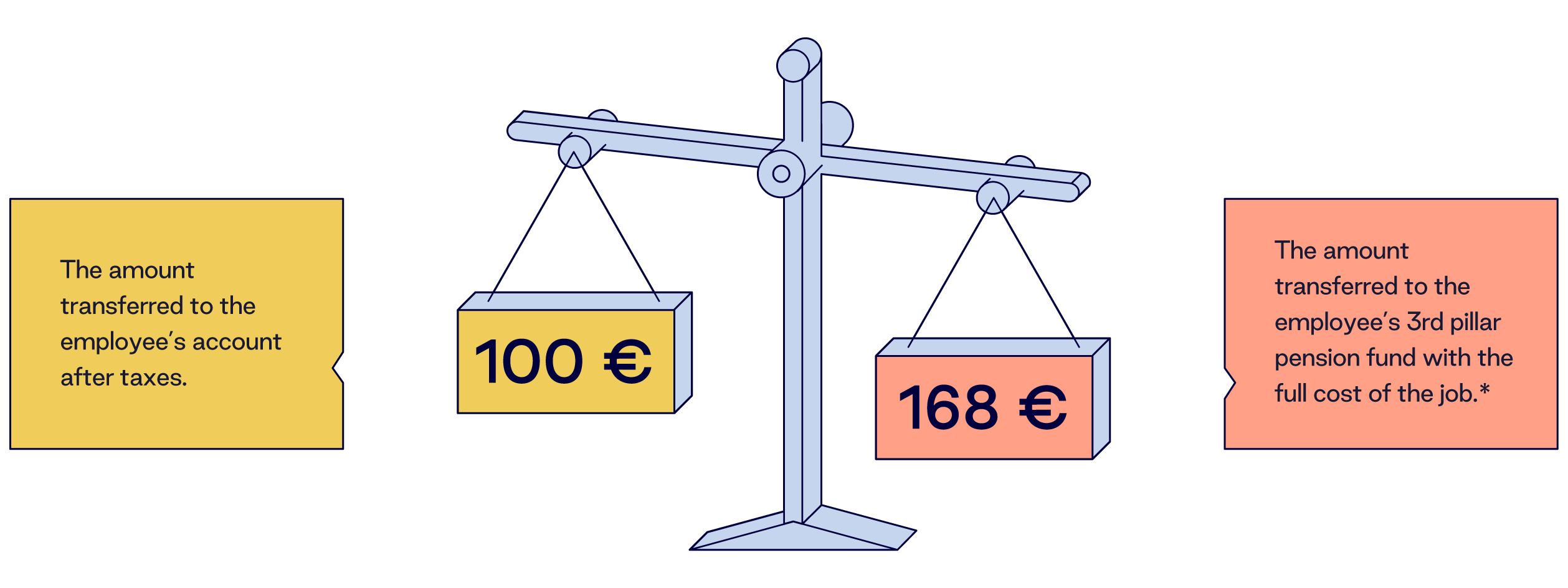

If your employer decides to give you a raise or a bonus, this money is subject to tax. It is not the case when your employer takes care of your future by paying contributions to your pension fund – this money is tax-exempt. If you choose to accumulate with your employer, you will receive more money in your 3rd pillar pension fund than you would have received in the ways mentioned above (since this amount tax-exempt).

If the employer decides to give €168 to the employee as an incentive, here is how this amount would be distributed in case of a bonus and in case of a contribution to the 3rd pillar pension fund:

* The advantage arises because contributions to pension funds are not subject to the taxes applicable to the payment of bonuses. This tax benefit applies, only if the contribution paid to the pension fund does not exceed 25% of the employee’s estimated employment-related income. The calculations do not take into account tax-exempt income. Please note that pension contributions paid by the employer for the benefit of an employee should not be paid in lieu of remuneration for the work performed or as part of the pay. For more information, please visit here.

The employee manages the agreement. This means that as soon as the contribution paid by the employer reaches your pension fund account, this money belongs to you. And if you change your job, leave the company or if your employer decides not to pay contributions anymore, you will decide what to do next. For example, you can choose to accumulate on your own or with your new employer. No obligations. Also, a 3rd pillar pension is inheritable.

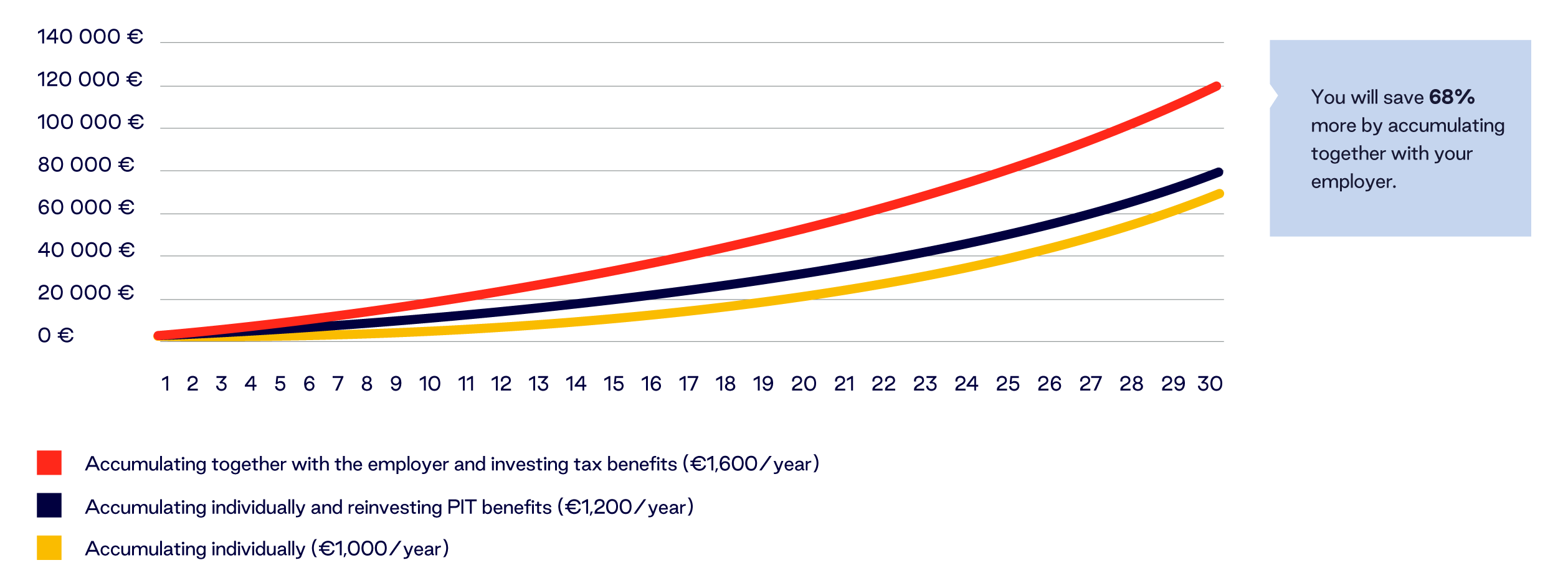

It is estimated that retired employees will receive from SODRA only up to 30% of their former salary. In 2022, with the qualifying period of employment, the average retirement pension paid by SODRA is only €487. The maximum SODRA pension is €978, even if you earn €10,000/month. By accumulating in a 2nd pillar pension fund, you would receive up to 50% of your pre-retirement salary. INVL financial experts recommend that a pension benefit should cover 70-80% of the pre-retirement income. You can achieve it through accumulation in all three pillars, while with your employer you could accumulate as much as 68% more.

The calculation assumptions are as follows: accumulation for 30 years with a 5% net return; no settlement or other fees; the PIT benefit is invested along with annual instalments; the amount of tax-exempt income does not apply, the full cost of the job is calculated, including taxes paid by the employer.

The 68% advantage arises because contributions to pension funds are not subject to the taxes applicable to the payment of bonuses. This tax benefits apply if the contribution paid to the pension fund does not exceed 25% of the employee’s estimated employment-related income. Please note that pension contributions paid by the employer for the benefit of an employee should not be paid in lieu of remuneration for the performed or as part of the pay. For more information, please visit here.

Participants in accumulation in pension funds assume the investment risk. Past investment performance does not guarantee the same results and profitability in the future.

Fill out the form. We will contact you and tell you all you need to know about pension accumulation with employer.

For the employer, we have put together all relevant information about the implementation of the programme. Register and we will share it with you.

Your employer is already considering accumulation? Accumulate with us – we work together with over 1000 companies. Contact us.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.