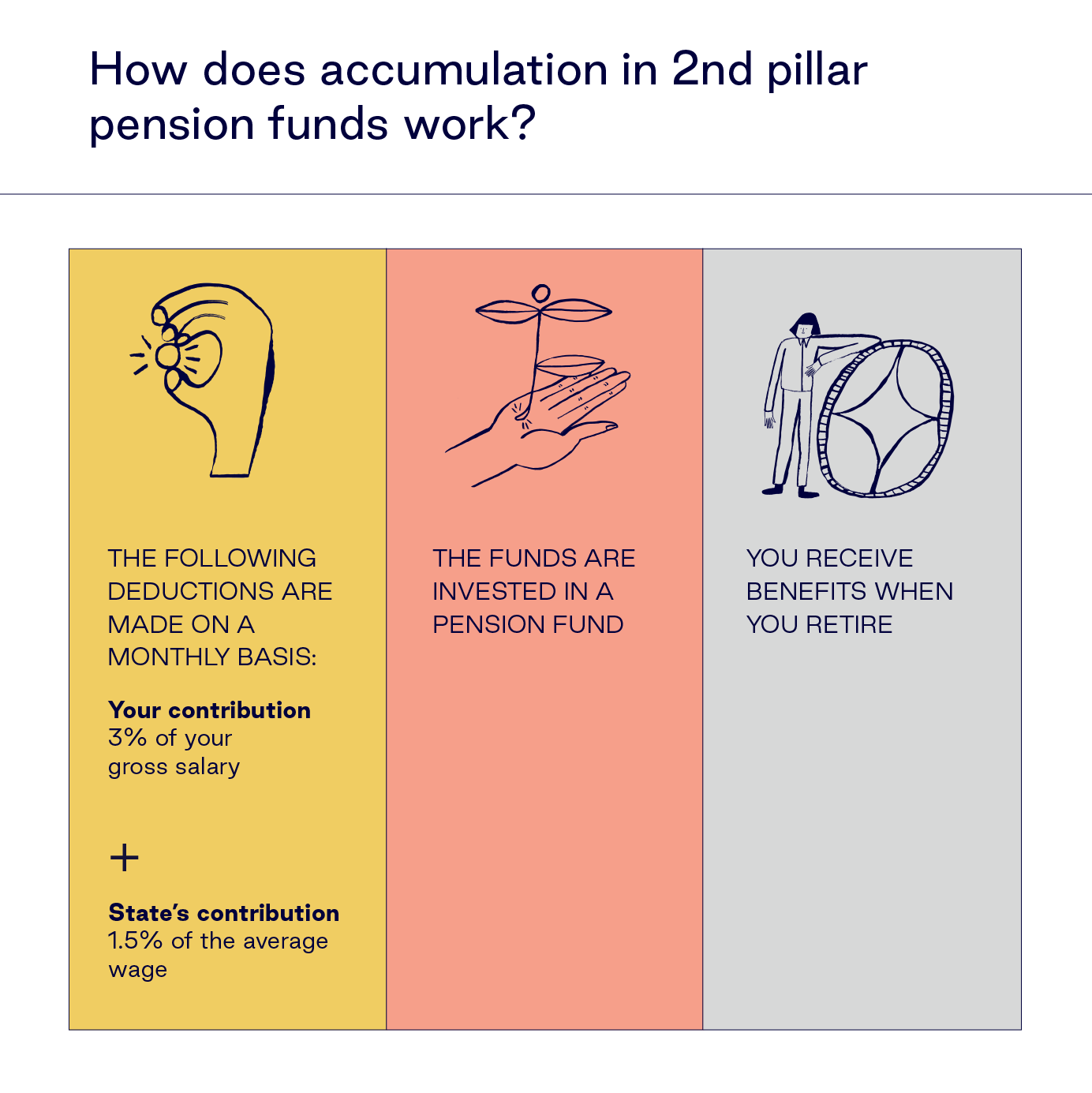

The 2nd pillar means accumulation in pension funds, allowing you to accumulate a pension which is up to 20-30% of your pre-retirement income.

The State also contributes to your 2nd pillar pension. In case of the 2nd pillar, your monthly contributions consist of your CONTRIBUTION, which is 3% of your gross wage, and the STATE’S INCENTIVE – 1.5% of the national average wage the year before last.

By the way, if you have ever suspended contributions to a 2nd pillar pension fund, your accumulated assets are further invested and you can resume your contributions at any time in the INVL self-service portal or at our office.

Register for a consultation

Accumulation in a 2nd pillar pension fund contributes to your welfare. The money you accumulate in the fund is invested. History shows that in the long run, as markets rise, the interest increases your assets and investments are protected from inflation. Funds are automatically deducted from your salary, so you don’t have to worry about that.

If you participate in maximum accumulation in a 2nd pillar pension fund, the State’s contribution is over €286 a year. Also, 2nd pillar pension funds have the lowest management fees compared to other investment instruments. The annual asset management fee for these funds will be only 0.5%.

The assets accumulated in a 2nd pillar pension fund are inheritable. Upon retirement, the accumulated assets or any part thereof may also be inherited, depending on the accumulated amount and the method of payment.

Sign the agreement online and start accumulating with INVL – it’s easy!

Start now

Choose a life-cycle fund based on your year of birth. Your fund will adjust your investment and risk to your age.

You can sign a 2nd pillar pension agreement at the INVL office or online. In the INVL self-service portal, you can sign a pension agreement in just a few minutes, using your Smart-ID, mobile signature or photo identification.

If you switch to INVL from another company, assets will be transferred to INVL within a few days. Log in to the INVL self-service portal and keep track of the accumulated assets, earned return on investment and the amount of contributions paid.

INVL 2nd pillar pension funds are managed in line with a life-cycle strategy. It is easy to accumulate in a pension fund because it is automatically selected based on your age. 18 years before your retirement, life-cycle funds begin to lower risk by reducing the proportion of shares and increasing the proportion of bonds in the fund.

By the way, you can change the fund to any riskier or less risky fund at any time. Just log in to the INVL self-service portal.

Learn more about the performance of INVL pension funds

Performance of fundsIt will take just a few minutes in the INVL self-service portal, or you can always register for a consultation with our specialists.

Sig upYou are free to choose a pension accumulation company. If you want to switch between companies, all you have to do is sign a pension accumulation agreement with INVL. You can do it at our Client Counselling Centre (in Vilnius, Kaunas or Klaipėda) or by logging into the INVL self-service portal. Instructions for signing the agreement in the self-service portal can be found here. If you prefer coming to the INVL Client Counselling Centre, please schedule your visit by calling us at +37070055959.

Once you have signed the new agreement, the accumulated assets will be transferred to the INVL pension fund of your choice.

You can do that by logging in to your personal SODRA account at http://www.sodra.lt/.

Depending on the fund’s investment strategy, pension funds managed by INVL invest in equities and other riskier asset classes (such as real estate or other alternative assets), as well as in bonds. While participants are young (under 47), it is recommended to keep up to 100% investments in equities and risky assets, then reduce their proportion by investing in bonds. Although the value of equities is more volatile, over the long run they allow you to earn more. The risk level of investing in bonds is lower and reduces the fluctuations in the value of accumulated assets as participants approach their retirement age.

When investing in equities, INVL is looking for opportunities on a global scale in order to replicate the return on equity worldwide as effectively as possible and thus grow the assets of participants in their pension funds. In addition, up to one-fifth of these investments go to the Baltic States, as well as Central and Eastern Europe, where we aim to earn higher-than-global returns. Meanwhile, in funds where participants are approaching the retirement age, we aim to preserve the accumulated assets and protect them from inflation, thus they are dominated by direct investments in bonds.

This investment model allows us to ensure a very wide range of equity investments and make use of undervalued companies or real estate in our region, while investing in bonds directly is more efficient compared to investing through bond funds. You can find the structure of each pension fund in their reports and reviews.

As of 2023, all 2nd pillar participants will accumulate according to the formula “3+1.5%” (a contribution by the participant of 3% of their gross wage plus a contribution by the State of 1.5% of the national average wage the year before last).

In 2023, the State’s incentive contribution for maximum accumulation is €23,85/month. Before the pension reform, those who participated in maximum accumulation automatically moved to the new formula as of 2019, while those who participated in minimum accumulation – in 2021 accumulated according to the formula “2.4+0.9%”, in 2022 accumulated according to the formula “2.7+1.2%” and in 2023 their accumulation formula has reached “3+1.5%”.

Accumulation in life-cycle funds is subject to an asset management fee, which is 0.5%. While the management fee for the asset preservation fund is only 0.2%. Some pension accumulation companies charge an exit fee, which can be up to 0.05% from the value of the accumulated assets.

Information about 2nd pillar pension accumulation fees applied by all pension accumulation companies is available here.

Depending on the amount accumulated in a 2nd pillar pension fund, you can choose a lump sum (where the amount is up to €5,403), periodic payments (where the amount is from €5,403 to €10,807) or a pension annuity (where the amount is from €10,807 to €64,841). In case of a pension annuity, it can be standard, inherited standard or deferred. A standard annuity means that the entire amount accumulated in the fund is spent on the acquisition of the annuity, and pension payments start immediately after you purchase the annuity and continue for the rest of your life. In case of a inherited standard annuity, benefits are also paid as long as you live with a guaranteed payment until the participant reaches the age of 80. If the participant dies earlier, the outstanding amount is inherited. In both cases of a standard annuity, the entire amount accumulated in the fund is spent on the acquisition of the annuity and the benefits are paid by SODRA in addition to the retirement pension paid by the State. A deferred annuity means that benefits are paid from the private pension fund from the time of retirement until the age of 85 (payments are made from the assets left after the acquisition of the deferred annuity) and these assets are inheritable. From the age of 85, benefits are paid by SODRA, but they are not inheritable). If you accumulate more than €64,841, the portion of the assets that exceeds this amount may be paid as a lump sum, and the remaining assets are paid in instalments for the rest of your life in accordance with your type of annuity.

More about pension benefits read here.

Subscribe to the newsletter and receive useful information on retirement savings and tips on financial management.

By clicking “Subscribe”, you agree to receive INVL Asset Management news and information about our services and products at the e-mail address provided. In accordance with the company’s privacy policy, this data will be stored for one year.

Please remember that for participants in 2nd pillar pension accumulation, the state social insurance retirement pension for the period prior to 31 December 2018 is proportionately reduced as established by law, except for persons participating in pension accumulation prior to 31 December 2018 who between 1 January 2019 and 30 June 2019 exercised their right to terminate pension accumulation – reduction of the state social insurance age-old pension will not apply to such persons. The additional State contribution does not reduce the amount of the retirement pension. A 2nd pillar pension accumulation agreement cannot be terminated, unless it is a first-time agreement, in which case the participant may unilaterally terminate the agreement within 30 calendar days after signing the agreement, by giving written notice to the pension accumulation company. Persons who became participants before 31 December 2018 had the right to terminate their participation in the accumulation of pensions or to suspend the transfer of pension contributions to the pension fund from 1 January 2019 to 30 June 2019.

Participants in accumulation in pension funds assume the investment risk. The pension accumulation company does not guarantee the profitability of pension funds. The value of a pension fund can go both up and down, and you can get back less than you invested. Past performance of a pension fund does not guarantee the same results and profitability in the future. Past performance is not a reliable indicator of future results.

Choose a pension fund responsibly and carefully. Please pay attention to investment risks and applicable deductions. Carefully read the rules of the pension fund, which are an integral part of the pension accumulation agreement.

Depending on the amount accumulated in a 2nd pillar pension fund, you can choose a lump sum (where the amount is up to €5,403), periodic payments (where the amount is from €5,403 to €10,807) or a pension annuity (where the amount is from €10,807 to €64,841). In case of a pension annuity, it can be standard, inherited standard or deferred. A standard annuity means that the entire amount accumulated in the fund is spent on the acquisition of the annuity, and pension payments start immediately after you purchase the annuity and continue for the rest of your life. In case of a inherited standard annuity, benefits are also paid as long as you live with a guaranteed payment until the participant reaches the age of 80. If the participant dies earlier, the outstanding amount is inherited. In both cases of a standard annuity, the entire amount accumulated in the fund is spent on the acquisition of the annuity and the benefits are paid by SODRA in addition to the retirement pension paid by the State. A deferred annuity means that benefits are paid from the private pension fund from the time of retirement until the age of 85 (payments are made from the assets left after the acquisition of the deferred annuity) and these assets are inheritable. From the age of 85, benefits are paid by SODRA, but they are not inheritable). If you accumulate more than €64,841, the portion of the assets that exceeds this amount may be paid as a lump sum, and the remaining assets are paid in instalments for the rest of your life in accordance with your type of annuity. More information about a pension annuity is available here.

All the information presented is of a promotional nature and cannot be construed as a recommendation, offer or invitation to accumulate assets in pension funds managed by INVL Asset Management. The information provided here cannot serve as a basis for any subsequently concluded agreement. Although this information of a promotional nature is based on sources which are considered to be reliable, INVL Asset Management is not responsible for any inaccuracies or changes in the information, or for any losses that may incur when investments are based on this information.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.