One way to ensure financial security for the future is to invest. Investment is a long-term process, the main goal of which is to “employ” part of the funds into return-generating assets and thus accelerate the accumulation of capital.

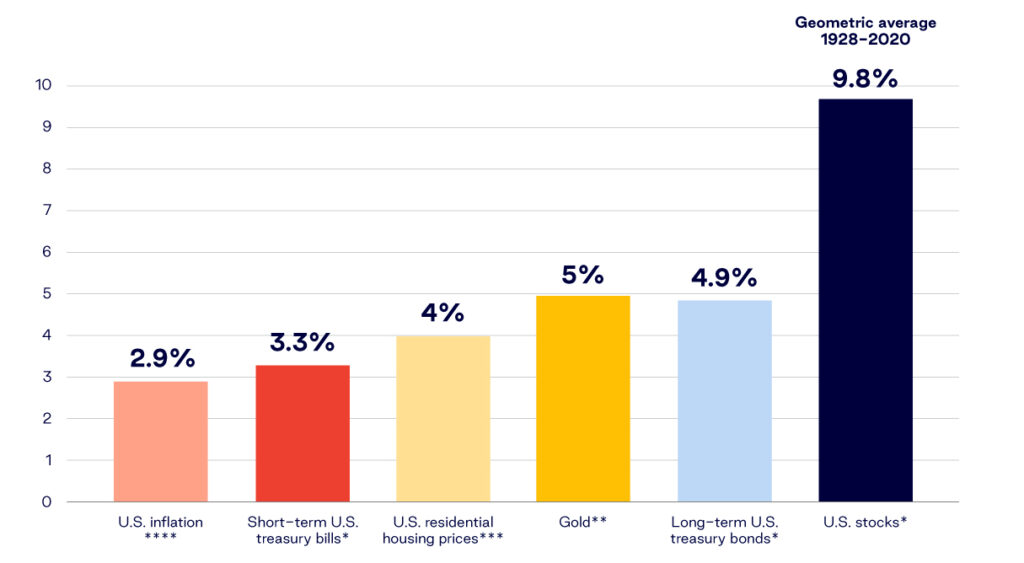

Based on the history of financial markets, depending on the type of asset classes, over the long-term you can expect to earn an average annual return of up to 10% on the invested capital.

Long-term historical data on return on investment in different asset classes (from 1928 to 2019) shows that investment has yielded returns in excess of inflation. In addition, a higher level of investment risk brings higher return on investment.

Sources: * www.stern.nyu.edu; ** minerals.usgs.gov; *** based on www.econ.yale.edu, **** based on www.measuringworth.com.

Periodic investment considerably reduces the risk of fluctuations, is attractive for those who don’t actively follow financial markets and doesn’t require a big starting capital, and yet helps to accumulate a significant amount of assets.

The graph below illustrates how, based on historical U.S. stock market returns, accumulated capital would have changed if $100 had been invested every month.

The investment management team that works in Invalda INVL group companies has more than ten professionals whose experience helps to select the most appropriate investments in every country and to reduce any potential risks.

Our professionals focus on the investments and regions that they know well, which is why they invest in company shares and bonds in global emerging market – from Estonia in the north to Argentina in the south. All these countries are different, but their economic development has some things in common, making it possible to identify opportunities and reduce the risk of failure.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.