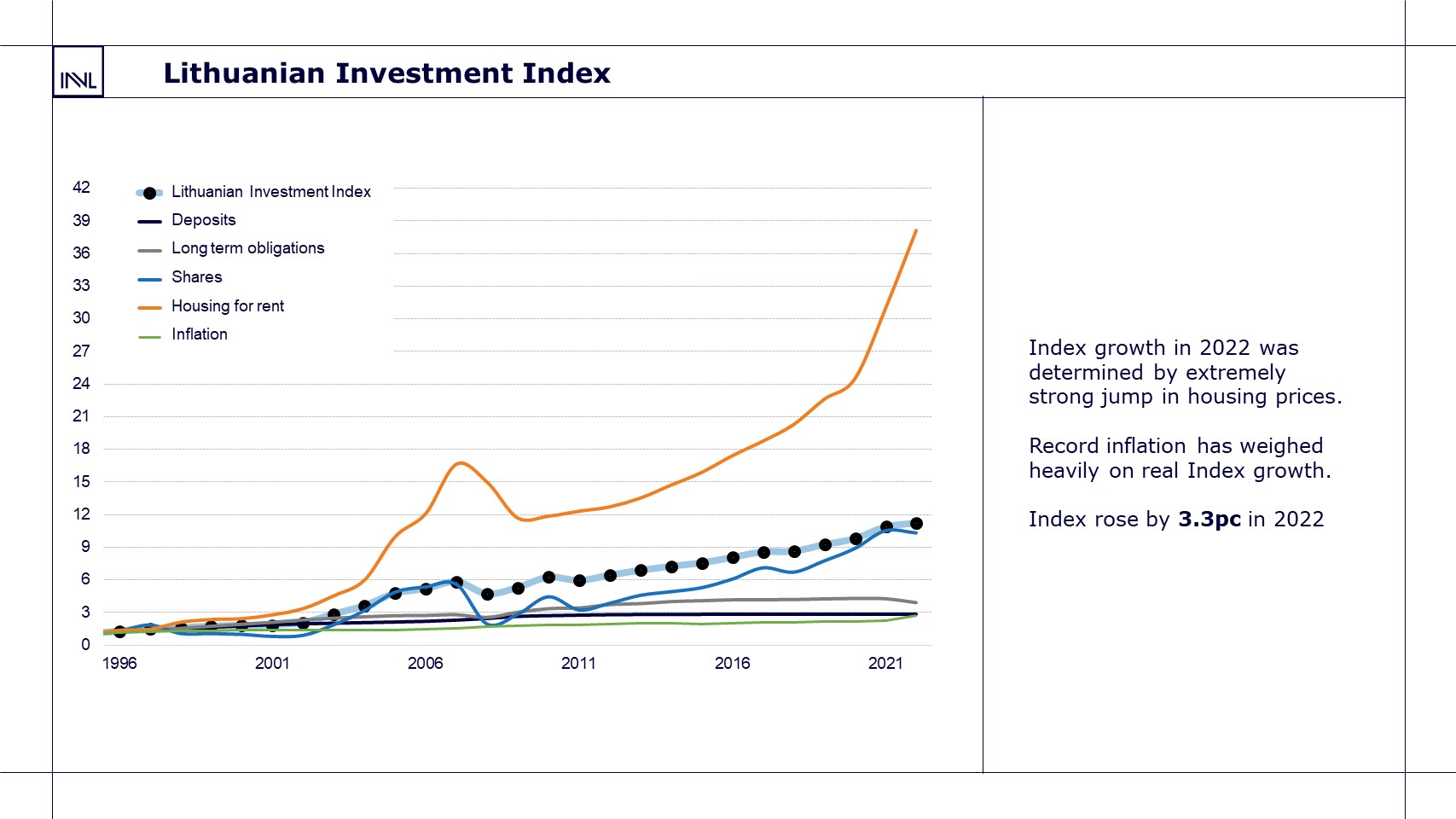

The Lithuanian Investment Index is developed by INVL Asset Management, one of the leading asset management firms in Lithuania. It shows how return on investment in Lithuania’s four main asset classes has evolved since 1996.

Lithuanian Investment Index (1996-2022)

The index is calculated on the basis of investment returns for short-term debt securities and money market instruments (deposits), long-term bonds, shares and rental housing (as of 2016 calculated net of expenses), each of which is given equal weight. The index shows how the value of these investments has changed each year.

Returns on the Lithuanian Investment Index and its component asset classes are presented through the end of 2022: from the inception of the index in 1996, over 10 years (2013-2022), and in 2022.

According to the Index, the average annual return on investment in Lithuania during the period of 1996-2022 was 9.4%, while in 2013-2022 it was 5.8%

In 2022, the Lithuanian Investment Index had a 3.3% gain, led by rental housing, which earned a return of 23.2%.

Inflation in 2022 was record 18.9%. Country’s long-term bonds earned -8.4%, and deposits, which had a 0.4% return.

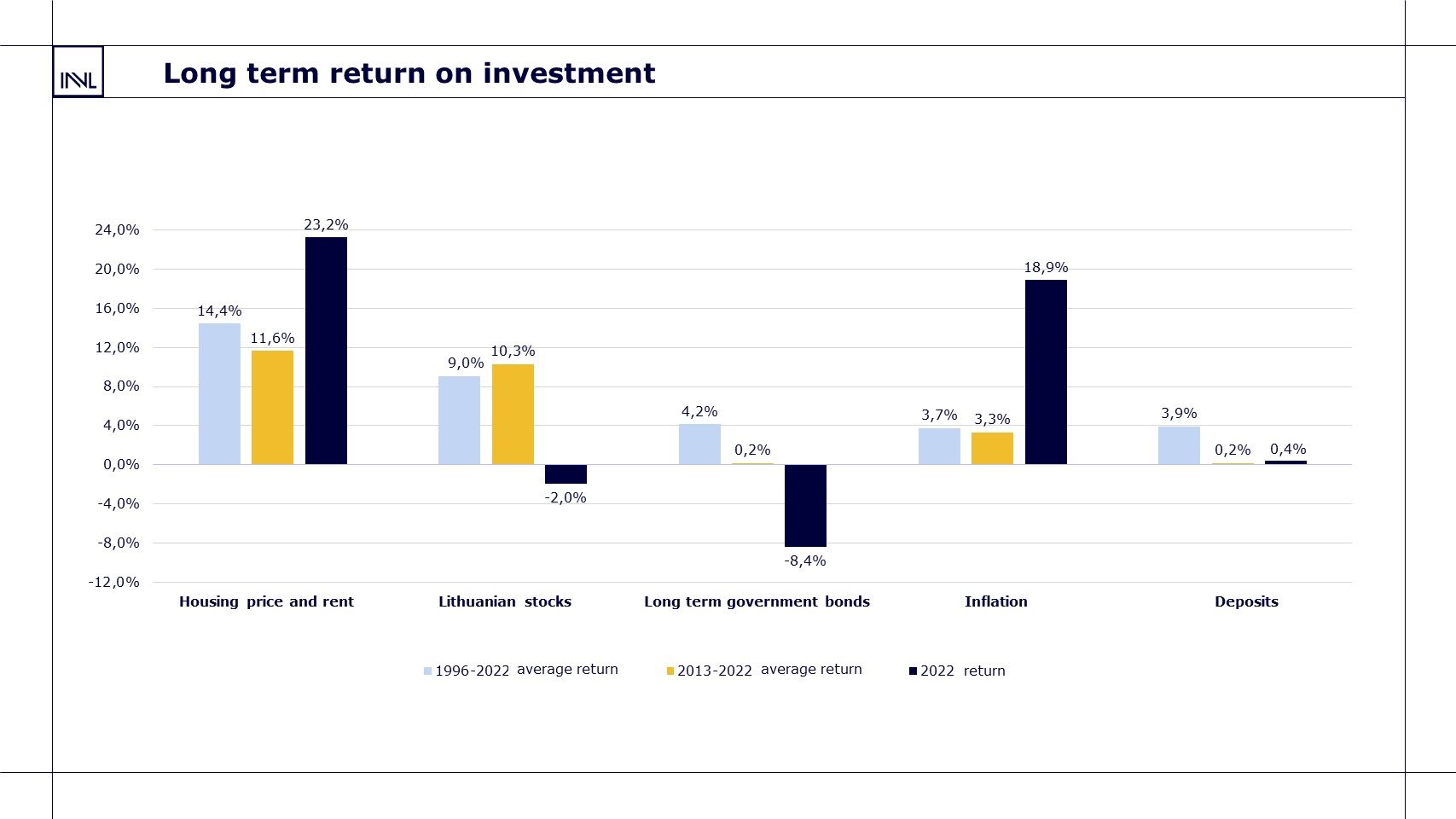

Long-term return on the Lithuanian Investment Index’s asset classes

The return on rental housing in Lithuania in 2022 grew impressively again. The value of which rose 19.1%, or 23.2% if rental income is included. Considering the last 10 years, the average annual growth in the value of Lithuanian rental housing was 11.6%, while in the period of 1996-2022 the average annual return on rental housing was 14.4%, making it the country’s most profitable asset class.

Lithuania’s stock market has lost 2% last year. Over a 10-year period their return was 10.3% and in the period of 1996-2022 it was 9%.

Looking at the performance of safe investments – long-term bonds – in Lithuania, the average annual return was 4.2% in the period of 1996-2022, 4.8% in 2013-2022 and -8.4 in 2022.

The return on Lithuanian deposits remained near zero in 2022 (0.4%), thus the long-term average return on this asset class since 1996 shrank to 3.9%.

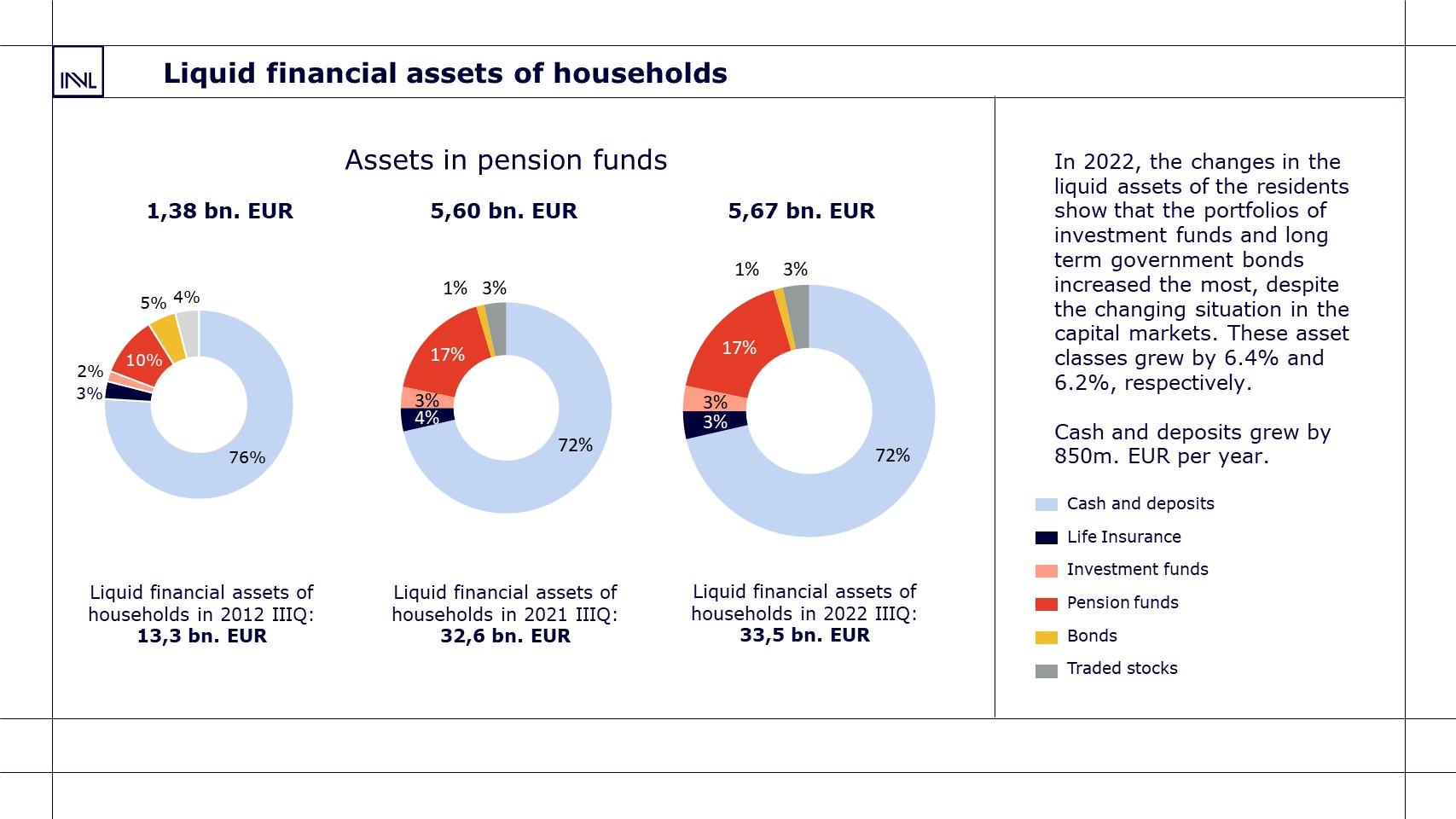

Returns of pension funds in 2022 – negative

Over the past 10 years, household assets have increased from 13.3 to 33.5 billion, but the structure of assets did not change significantly. The share of cash and deposits decreased by 4 percentage points, but still accounts for 72 pc. of liquid household financial assets. Last year alone, their amount increased by 850m. EUR. The share of assets contained in pension funds has increased by 7 percentage points. Residents currently own 5.67 billion EUR in pension funds – significant increase from 1.38 billion EUR in 2013 and the share of the accumulated assets grew fastest due to the peculiarities of the Lithuanian pension accumulation system and the significant return on investment in the long term. After solid growth in 2021, last year’s pension funds return was negative.

Individual asset classes yield different returns in different periods, so to reduce risk and sustain investment gains, spreading investments over a variety of areas is recommended.

| Asset class* | 1996-2021 m. average annual return (%) | 2012-2021 m. average annual return (%) | 2021 m. return (%) |

| Housing for rent (costs estimated from 2016 in Lithuania) | 14.4 | 11.6 | 23.2 |

| Housing price in Lithuania | 7.3 | 7 | 19.1 |

| Shares of Lithuanian companies | 9 | 10.3 | -2 |

| Lithuanian short-term debt securities and money market instruments (deposits) | 3.9 | 0.2 | 0.4 |

| Lithuanian long – term bonds | 4.2 | 0.2 | -8.4 |

| Lithuanian 2nd pillar pension funds | 4.8** | 4.8 | -13.8 |

| Infliation | 3.7 | 3.3 | 18.9 |

| Lithuanian investment index | 9.4 | 5.8 | 3.3 |

* Housing acquisition and rental returns calculated on the basis of Ober-Haus data. ** Since creation in 2004.

Read more in press release.

The Lithuanian Investment Index is an initiative of INVL Asset Management. Any use of the data herein must identify INVL Asset Management as the source.

Information is provided for information purposes only and cannot be construed as a recommendation, offer or invitation to invest in funds or other financial instruments managed by INVL Asset Management. When investing, you assume the investment risk. Investments can be both profitable and loss-making, you may not obtain financial benefits and you may lose some or even the entire invested amount. Past results of investments do not guarantee future results. When you make an investment decision, assess all the risks associated with investing and the key investor information documents. INVL Asset Management is not responsible for any inaccuracies or changes in this information or for any losses that may arise when investments are based on this information.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.