Specialized Emerging markets expertise

We possess Emerging market business experience, investment expertise, cultural ties and on-the-ground presence for almost 30 years

Seasoned investment team

Our investment team is one of the largest and most experienced in the region, with solid track record in each asset class

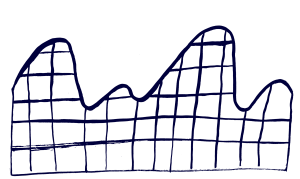

Niche strategies to enhance your portfolio results

Providing niche, lower correlation exposures in a unique region our strategies are focused on maximizing risk adjusted returns

Active management, high conviction bets, off-benchmark picks

Our active management approach creates alpha in less efficient markets by uncovering misunderstood, overlooked, off-benchmark opportunities

We are a part of UN-supported Principles for Responsible Investment (PRI) network since 2017 aiming to apply the principles in our investment activities as we believe that long term investment results go hand in hand with responsibility.

We assess ESG related risks and opportunities in our investment analysis and monitoring. We exercise our voting rights in the portfolio companies considering the ESG factors. We believe that this approach helps in maximizing the long-term value to our investors.

By many measures, the most advanced group of Emerging markets, offering a combination of EM level growth and asset prices with Western European level of development and governance standards.

Due to moderate size of the region Baltic countries and Emerging Europe do not enjoy the same level of attention and big-name investor coverage as other Emerging markets, providing an opportunity to such active region specialists like us.

World‘s economic growth engine and most dynamic markets offering particularly favorable demographics and attractive valuations with notably lower government debt levels compared to Developed markets.

A diverse group of commodity, tourism, manufacturing and services focused economies that are home to 85% of world‘s population, responsible for 60% of global GDP and 80% of global growth. Global EMs exposure provides attractive returns in a low yield environment.

Our suite of UCITS compliant funds include Emerging Europe Bond, Global Emerging Markets Bond, Baltic Equity funds. Common to all our UCITS funds is benchmark agnostic and high conviction investment philosophy leveraging our regional expertise.

Our flagship strategy focused on hard-currency sovereign and corporate debt securities in Emerging Europe. High conviction, high active share strategy targets average investment grade rating and average duration of up to 3 years.

More info about the fund can be found here.

Nimble EMD strategy focused on capturing yield and growth in rapidly developing economies. Alpha is generated through high active share, high conviction exposures to market mispricings, arbitrage of different currency issues, off-benchmark opportunities and avoidance of value destroying issuers.

More info about the fund can be found here.

Investment in shares of companies listed on Baltic Stock Exchange or enterprises actively operating in the Baltic States. Our local market fund focuses on long-term investments by identifying attractive economic sectors and picking undervalued companies.

More info about the fund can be found here.

Our alternative investment funds offer exposure to niche private markets in Baltic countries and Emerging Europe and include Baltic sea region private equity, Senior secured private debt as well as Sustainable Timberland and Farmland fund.

A niche strategy focused on Baltic and certain Eastern Europe countries where the forest and farmland markets are fragmented, underdeveloped and attractively priced. Fund‘s main sources of alpha include consolidation, harvesting, rent and economic activity.

More info about the fund can be found here.

A senior secured short term private debt strategy with a particular focus on alternative financing sector. Relationships with portfolio companies supporting their growth and development over a longer term.

More information about the fund can be found here.

The largest PE fund in the Baltics with EUR 165 M under management. Fund‘s strategy is industry agnostic and focused on structural transformation, operational improvements, regional cross border expansion and growth acceleration of the portfolio companies.

More information about the fund can be found here.

We offer management of bespoke portfolios in line with our Emerging Europe and Global Emerging market fixed income strategies or a tailor made EMD strategy adjusted according to institutional investors’ unique objectives and risk tolerance.

Our approach to EMD is high active share, benchmark agnostic, capital preservation focused investing exploiting moderate region‘s investor coverage and our home market expertise.

Why invest in EMD? Attractive returns in a low yield environment driven by growth advantage, favorable demographics, relatively low level of government debt along with low valuations.

We offer management of bespoke portfolios in line with our Baltic equity strategies or a tailor made regional equity strategy adjusted according to institutional investors’ unique objectives and risk tolerance.

Our approach to Baltic equities is benchmark agnostic, high conviction bottom up investment exploiting deep value, event driven, dividend and activism themes in undervalued markets where we possess the deepest knowledge and experience.

Why invest in Baltic equities? Under-researched markets that offer upside potential and pockets of opportunity due to attractive valuations and lower market efficiency.

We offer management of bespoke investment portfolios to companies in financial technology sector aiming to safely invest client funds. Negative interest rates by central and commercial banks encourage looking for alternatives in the bond market and INVL Asset Management has successful experience in bond portfolio management for e-money and e-payment institutions in Baltics. We adjust the portfolio strategy and parameters based on investment restrictions applied to the fintech sector companies by local regulator.

You can contact us by an email: b2i@invl.com

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.