|

Basic data

|

Start of operations

2019-01-02

|

Manager

INVL Asset Management

|

||

|

Newest Data

|

Date

2023-11-29

|

Unit value

1,0607 EUR

|

Net assets

17.737.665,67 EUR

|

|

|

Change in value

|

1 day

+0,26 %

|

1 month

+2,51 %

|

3 months

+1,56 %

|

1 year

+5,68 %

|

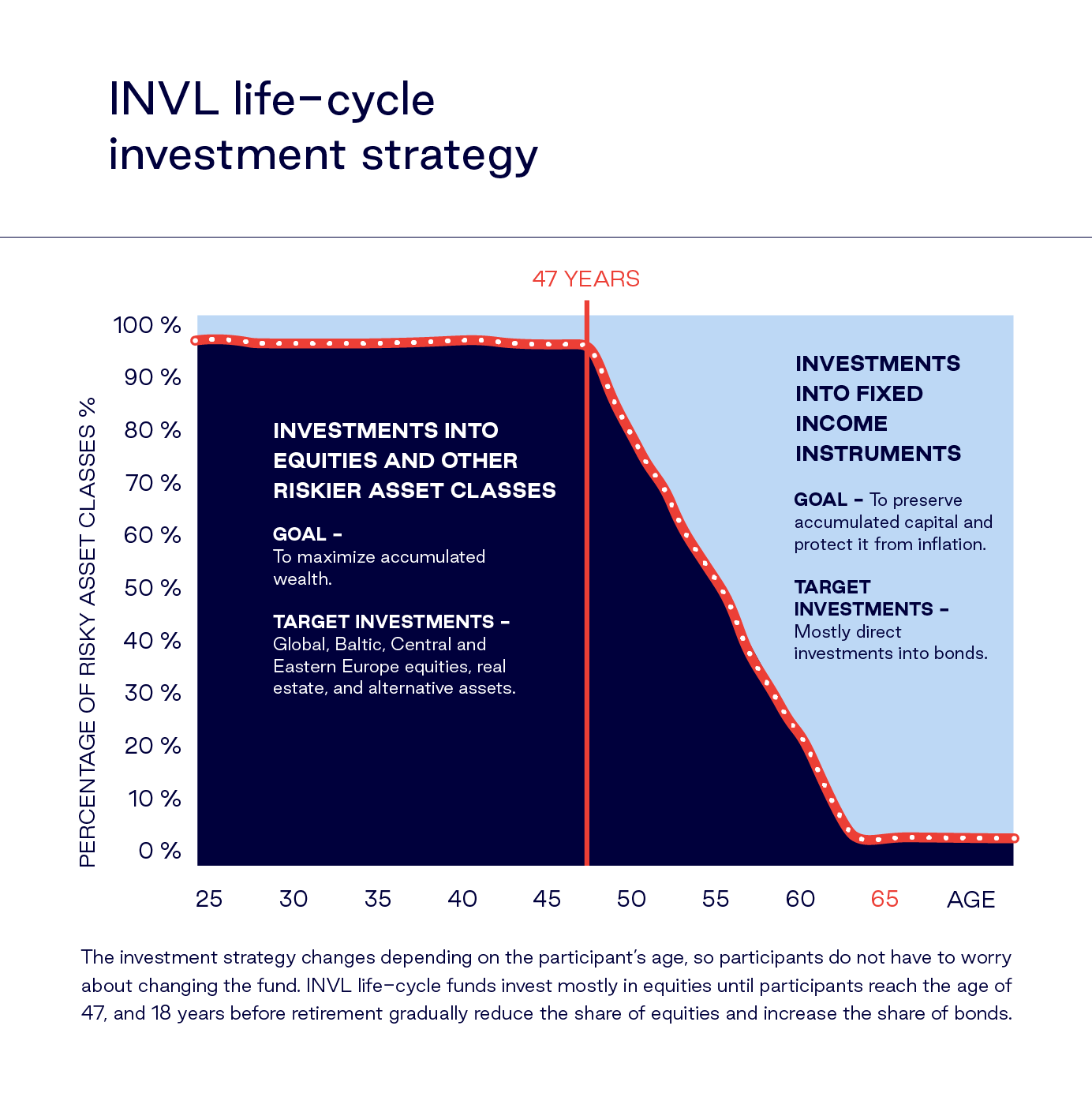

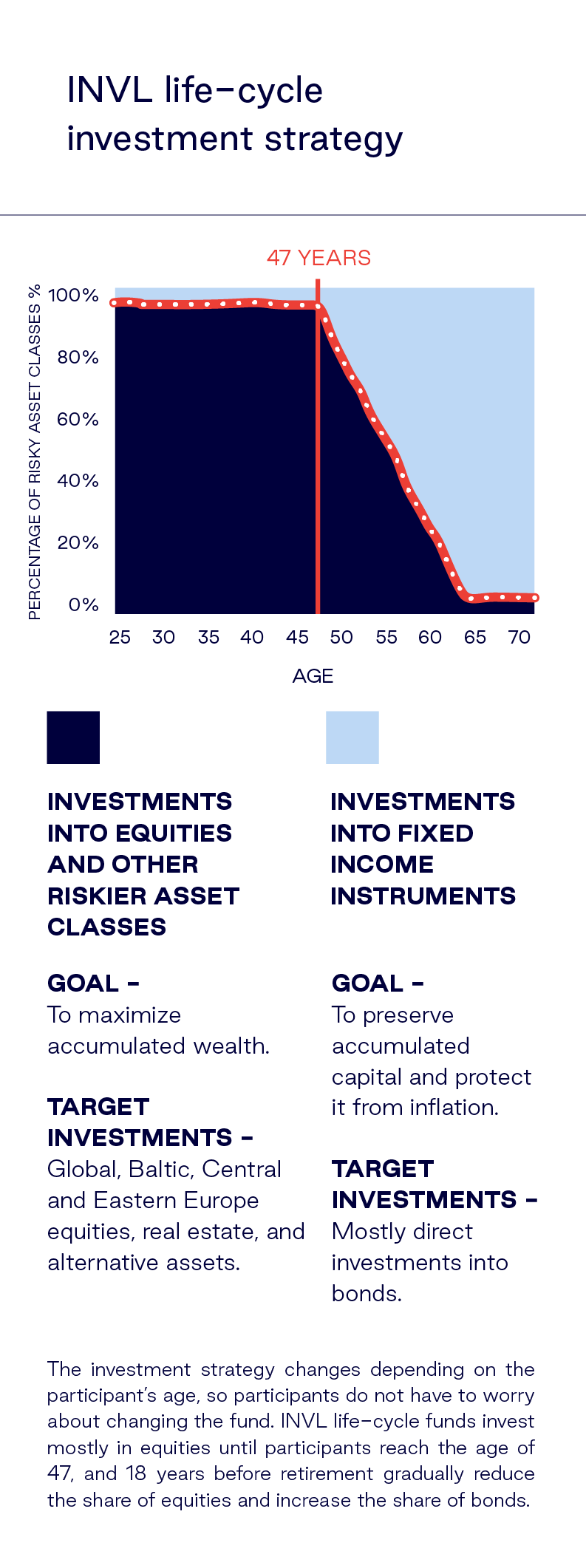

INVL Pension 1954-1960 Index Plus is a target group life-cycle fund for pension accumulation participants who meet the established limits of the year of birth. It invests in equities until the participant reaches the age of 47. 18 years before retirement, the fund starts reducing the proportion of equities and increasing the proportion of bonds. At the age of 64, the target proportion of equities in the fund reaches 10%, but can range from 0 to 20%.

A benchmark describes the fund’s investment strategy and is made up of indices showing individual asset classes. The fund’s compliance with the benchmark is described by a tracking error with a maximum possible value of 5%.

The benchmark varies over time, depending on the average age of the participant. The total share of risky asset classes decreases by 5.12%/n each business day (the number of n-business days in the current year). The proportion of risky asset classes (i.e. shares) in the INVL Pension 1954-1960 Index Plus fund’s benchmark is reduced from the beginning of 2019 to a fixed proportion in 2020. At the same time, the proportion of less risky asset classes (i.e. money market instruments and bonds) is increasing.

More detailed information about changes in the benchmark is available in the investment strategy, section “Description of the strategic pension asset allocation”.

More about the benchmark or the component indices read here.

Structure on 22 March 2022:

9,18% MSCI ACWI IMI Net Total Return USD Index (MIMUAWON Index) (converted to EUR)

0,82% MSCI Emerging Markets Net Total Return USD Index (M1EF Index) (converted to EUR)

3,00% European Central Bank ESTR OIS Index (OISESTR Index)

22,33% Bloomberg Barclays Series-E Euro Govt 1-3 Yr Bond Index (BERPG1 Index)

22,33% Bloomberg Barclays EuroAgg Corporate 1-3 Year TR Index Value (LEC1TREU Index)

22,33% J.P. Morgan Euro Emerging Markets Bond Index (EMBI) Global Diversified Europe (JPEFEUR Index)

10,00% Bloomberg Pan-European High Yield (Euro) TR (I02501EU Index)

10,00% J.P. Morgan Emerging Markets Bond Index (EMBI) Global Hedged Euro Index (JPEIGHEU Index)

Structure on 1 March 2021:

9,18% MSCI ACWI IMI Net Total Return USD Index (MIMUAWON Index) (converted to EUR)

0,82% MSCI Emerging Markets Net Total Return USD Index (M1EF Index) (converted to EUR)

3,00% European Central Bank ESTR OIS Index (OISESTR Index)

22,33% Bloomberg Barclays Series-E Euro Govt 1-3 Yr Bond Index (BERPG1 Index)

22,33% Bloomberg Barclays EuroAgg Corporate 1-3 Year TR Index Value (LEC1TREU Index)

22,33% J.P. Morgan Euro Emerging Markets Bond Index (EMBI) Global Diversified Europe (JPEFEUR Index)

10,00% J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Europe Index (JCBBEURO Index), hedging Bloomberg USDEUR 6 Month Hedging Cost Index (FXHCUE6M Index)

10,00% J.P. Morgan Emerging Markets Bond Index (EMBI) Global Hedged Euro Index (JPEIGHEU Index)

Structure on 2 January 2019:

13,87% MSCI ACWI IMI Net Total Return USD Index (MIMUAWON Index) (converted to EUR)

1,25% MSCI Emerging Markets Net Total Return USD Index (M1EF Index) (converted to EUR)

3,00% EONIA Total Return Index (DBDCONIA Index)

20,63% Bloomberg Barclays Series-E Euro Govt 1-3 Yr Bond Index (BERPG1 Index)

20,63% Bloomberg Barclays EuroAgg Corporate 1-3 Year TR Index Value (LEC1TREU Index)

20,63% J.P. Morgan Euro Emerging Markets Bond Index (EMBI) Global Diversified Europe (JPEFEUR Index)

10,00% J.P. Morgan Corporate Emerging Markets Bond Index (CEMBI) Broad Europe Index (JCBBEURO Index), hedging Bloomberg USDEUR 6 Month Hedging Cost Index (FXHCUE6M Index)

10,00% J.P. Morgan Emerging Markets Bond Index (EMBI) Global Hedged Euro Index (JPEIGHEU Index)

Details of the depository protecting the assets of the pension fund:

AB SEB bankas,

Konstitucijos pr. 24, 08105, Vilnius.

For participants of 2nd pillar pension accumulation, the state social insurance old-age pension for the period prior to 31 December 2018 is being gradually reduced as established by law, except for participants of pension accumulation prior to 31 December 2018 who between 1 January 2019 and 30 June 2019 exercised the right to terminate pension accumulation – reduction of the state social insurance old-age pension will not apply to them. The state’s additional contribution does not reduce the size of the old-age pension. A 2nd pillar pension accumulation agreement which is in effect may not be terminated except for a first-time agreement, which the participant has the right to terminate unilaterally within 30 calendar days of making the agreement by notifying the pension accumulation company about that in writing. Persons who became participants before 31 December 2018 had the right from 1 January 2019 to 30 June 2019 to terminate their participation in pension accumulation or suspend the transfer of pension contributions to the pension fund.

Accumulating in pension funds involves assuming investment risk. The pension accumulation company does not guarantee the profitability of pension funds. A pension fund’s unit value can both rise and fall. You may recover less than you invested. Past results of the management of a pension fund’s investments do not guarantee the same type of results and profitability in the future. The results of a past period are not a reliable indicator of future results.

We recommend selecting a pension fund responsibly and carefully, paying attention to the risks and applicable deductions associated with investments and carefully reading the pension fund rules which are an integral part of the pension accumulation agreement.

Depending on the amount accumulated in a 2nd pillar pension fund, it may be withdrawn as a lump sum (for less than EUR 5,403) or by periodic payments (for EUR 5,403to EUR 10,807), or a pension annuity may be acquired (when EUR 10,807 to EUR 64,841 is accumulated) which may be one of three types: standard, inherited standard or deferred. In the case of a standard annuity, the entire accumulated amount is allocated to acquire the annuity, with pension payments starting as soon as the annuity is acquired and continuing as long as you live. For an inherited standard annuity, payments are also made as long as you live, but time payment until the participant reaches the age of 80 is guaranteed – if the participant dies earlier, the unpaid amount can be inherited. For both types of standard annuity, the entire accumulated amount is allocated to acquire the annuity and the state social insurance fund pays the benefits in addition to the old-age pension paid by the state. In the case of a deferred annuity, until the age of 85 benefits are paid from the private pension fund (out of the assets remaining after acquisition of the deferred annuity) and those assets can be inherited. From the age of 85, meanwhile, benefits are paid by the state social insurance fund and are not inheritable. If more than EUR 64,841 is accumulated, then the pension assets exceeding that amount may be paid out as a lump sum, while the remainder is paid while you live according to the type of annuity acquired. You can learn more about pension annuities here.

All the information presented is of a promotional nature and cannot be construed as a recommendation, offer or invitation to accumulate money in pension funds managed by INVL Asset Management. The information provided here cannot be the basis for any subsequently concluded agreement. Although this information of a promotional nature is based on sources considered to be reliable, INVL Asset Management is not responsible for inaccuracies or changes in the information, or for losses that may arise when investments are based on this information.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.