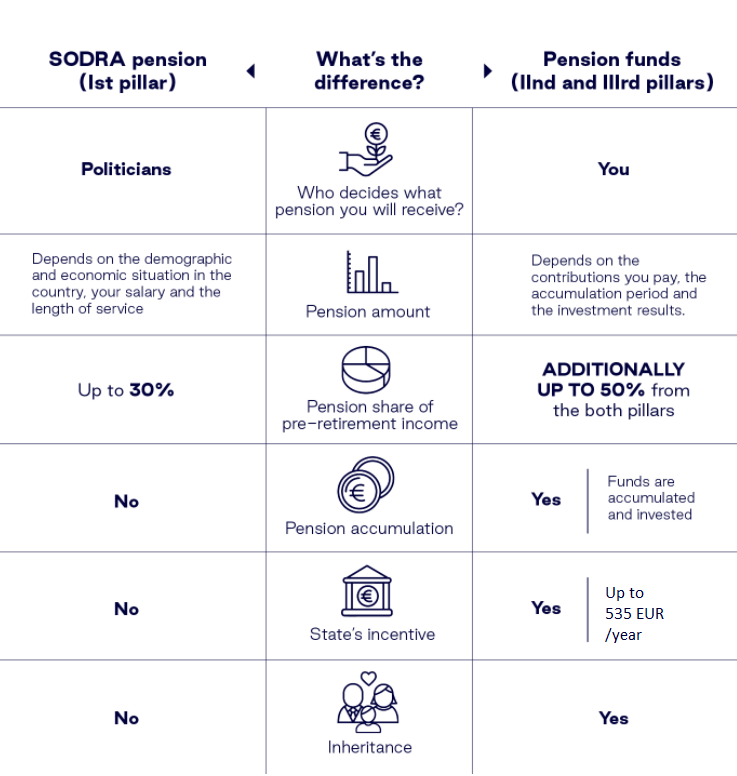

A retirement pension paid by SODRA is the first pillar of the pension system. It depends directly on the number of tax-paying workers in the country. It is estimated that with the deteriorating demographic situation, the average SODRA pension will be only up to 30% of the pre-retirement income.

What can you do to increase your income? Accumulate in 2nd and 3rd pillar pension funds. Depending on how much money you have accumulated in the funds, your pension can reach 70 to 80% of your pre-retirement income.

The assets accumulated in a pension fund are invested in shares of several thousand companies around the world and government bonds. Your investments are managed by professional investors, and the assets of the pension fund are separated from the assets of the company that manages it, so the pension fund cannot go bankrupt.

The longer a company operates in the market, the more experience it has. Time-tested companies know how to successfully meet their clients’ financial expectations. INVL has been operating in the pension market since the launch of the pension system in Lithuania.

Make sure the return of the fund you chose is in line with your financial goals. You can find these and other performance indicators in the reviews of the Bank of Lithuania.

Choose professionals. The return and performance of funds depend on the people who manage them. INVL pension funds are managed by the largest team in the field. Our competence is proven by the long-term return of our funds and international recognition.

We have been operating in the pension market since the launch of the pension system in 2004. We are happy that our results are noticed by more and more people who save for their retirement and the number of participants in INVL 2nd pillar pension funds grew the fastest in the last 5 years.

Start accumulating – it’s easy! You can do this online in

just a few minutes.

Become our client

Log in to the INVL self-service portal, where you will find information about your accumulated pension assets and notifications only for you

Login for clientsSubscribe to the newsletter and receive useful information on retirement savings and tips on financial management.

By clicking “Subscribe”, you agree to receive INVL Asset Management news and information about our services and products at the e-mail address provided. In accordance with the company’s privacy policy, this data will be stored for one year.

Choose a pension fund responsibly and carefully. Before signing a pension accumulation agreement for accumulation in 2nd and/or 3rd pillar pension funds, pay attention to investment risks and applicable deductions. Carefully read the rules of the pension fund, which are an integral part of the pension accumulation agreement.

Investing in 2nd and 3rd pillar pension funds involves investment risk. The value of a pension fund can go both up and down, and you can get back less than you invested. Past performance of a pension fund does not guarantee the same results and profitability in the future. Past performance is not a reliable indicator of future results. You are responsible for your investment decisions regarding pension accumulation. Before you make an investment decision, assess all the risks associated with the investment yourself or with a help of investment consultants.

Please remember that for participants in 2nd pillar pension accumulation, the state social insurance retirement pension for the period prior to 31 December 2018 is proportionately reduced as established by law, except for persons participating in pension accumulation prior to 31 December 2018 who between 1 January 2019 and 30 June 2019 exercise their right to terminate pension accumulation and return the accumulated money to SODRA – reduction of the state social insurance age-old pension will not apply to such persons. SODRA pension will not be reduced for those participating in 2nd pillar pension accumulation as of 2019. The additional State contribution does not reduce the amount of the retirement pension.

All the information presented is of a promotional nature and cannot be construed as a recommendation, offer or invitation to accumulate assets in pension funds managed by INVL Asset Management. The information provided here cannot serve as a basis for any subsequently concluded agreement. Although this information of a promotional nature is based on sources which are considered to be reliable, INVL Asset Management is not responsible for any inaccuracies or changes in the information, or for any losses that may incur when investments are based on this information.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.

Please select Your topic on SB.lt webpage.

![]()

INVL and Šiaulių bankas merged their retail services as of 1 December 2023.